AI-ML

Advances in Information Technology (IT) based on improvements in hardware and software enabled the success of Machine Learning (ML). Today, the applications of robots, automation, and models with capacity to learn from data are becoming commonplace. This makes the tailoring of applications possible to draw insights from complex and high dimensional data sets. We are promised a future of self-driving cars and autonomous decision making by AI agents and robots. Media press releases on this topic tend to focus on the spectacle and therefore paint an outlook of either an overly bright or grim future, whatsoever outlook appears best suitable to the narrative spreaded to the public.

Undeniable, machine learning has become increasingly popular with applications in many areas including Finance. Before applying a machine learning model however, the model has to learn from input data and examples of what output is expected given the input data. The Learning process, aka model training, has the aim to narrow the "distance" between the model's current output and its expected output.

At AURISCON, we are in the position of having in depth knowledge of analytics and data. We confidentially deal with your data and analytical models and aim to identify gaps to industry standards and opportunities for improvements. Based on extensive expierence, we add Machine Learning context to your Analytics and Strategy and commonly draw on business insights to deliver useful solutions. We assist with review and integration of machine learning techniques for use in your analytics and wider strategy.

Among the multiple methodogies used in machine learning Regression, Trees and Artifical Neural Networks are useful methods for generation of predictive scores. Regression methods are transparent in disclosing the impact drivers have on generating a predictive score. Neural Networks are more complex and black box in nature.

Deep learning at the time of writing is the most recent advancement in Neural Networks consisting of many layers. Deep learning in particular has enabled breakthroughs and applications in multiple areas such as speech transcription, image classification, text to speech conversions and many others. In the context of timeseries data, multiple applications useful of deep learnng exist such as classifying a stream of data by putting a categorical label on data set, and detecting anomalies in timeseries data. In Finance forecasting based on timeseries data is a common task with the Recurrent Neural Network (RNN) technique being the underlying method employed.

An important branch of Machine Learing techniques is classified under Supervised Learning. For Supervised Learning both observation and outcome data are available for model training. Applications in fraud detection and target marketing for instance are trained this way. Unsupervised Learning on the other hand is a technique that is used when outcome data is not available. A third branch of techniques is labeled Reinforcement Learning. Reinforcement Learning is useful for situation where no observations and outcome data are avalable initially, but rather the algorithm works by learning on a case by case basis through evaluation of success and reward measures. Reinforcement Learning has proven its usefulness for complex problems such as 'learning chess', where even large data samples won't exhaust the many combinations and scenarios possible.

Listed below are techniques commonly used in Machine Learning. A heuristic description of techniques is presented in the blog section for illustration (cf. link above).

Techniques commonly used in Machine Learning

Principal Componenent Analytis

Cluster Analysis

Logistic Regression

Tree Based Methods

Boosted Trees

Deep Learning with Recurrent Networks

Bayesian Networks

Reinforcement Learning

Regularizaton

Resampling Methods

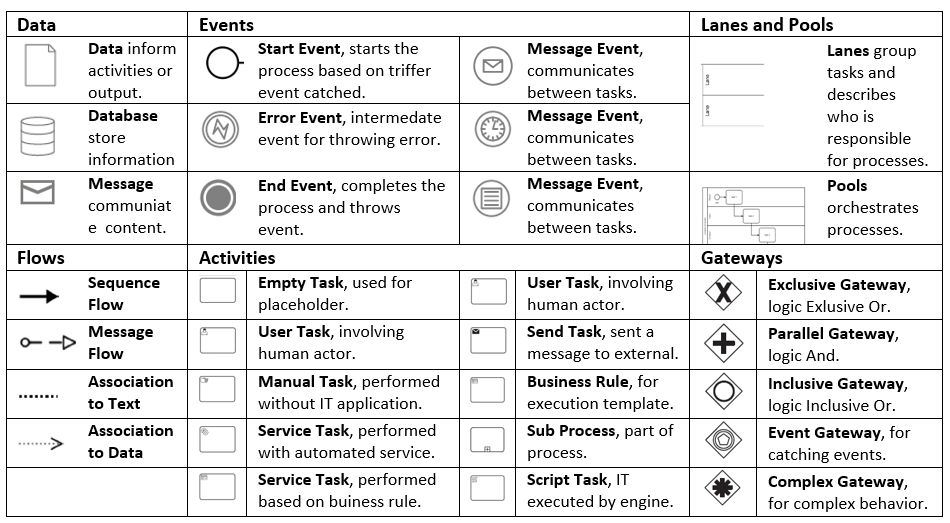

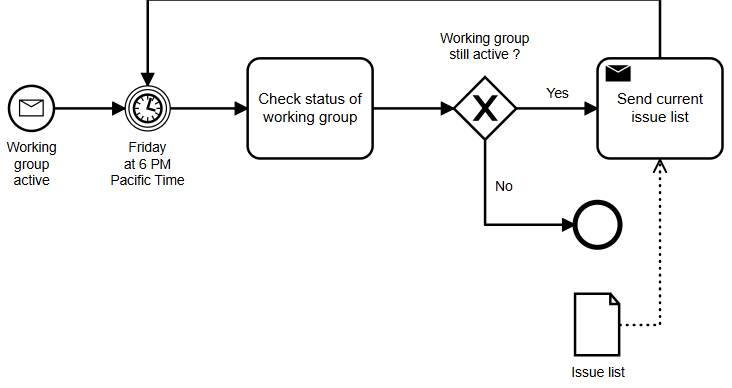

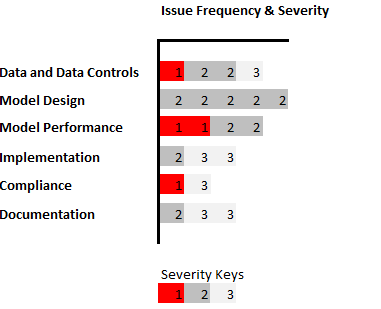

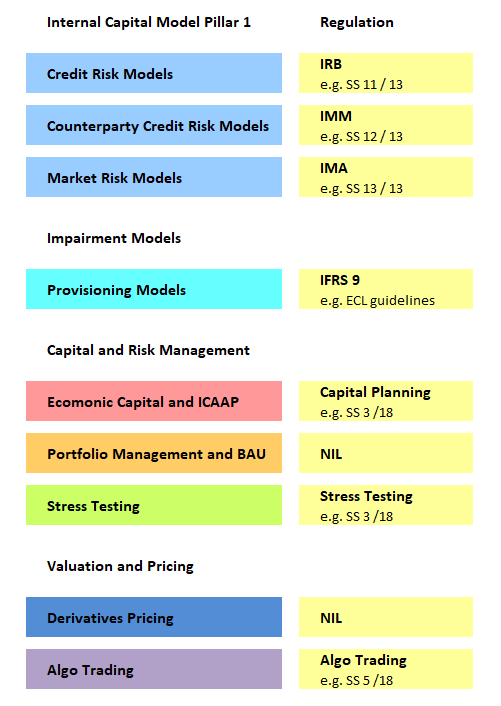

Ongoing expansion of banking regulations was leading globally to mupliplication of standards and enhancement of requirements. Organsiations aim to achieve adherence to standards with delivery on requirements through various channels: competence in methods, effectiveness in processes based on state of the art IT archtitectures, and high quality data management.

Ongoing expansion of banking regulations was leading globally to mupliplication of standards and enhancement of requirements. Organsiations aim to achieve adherence to standards with delivery on requirements through various channels: competence in methods, effectiveness in processes based on state of the art IT archtitectures, and high quality data management.