As a result of IFRS9, the IASB demised the Incurred Loss standard and replaced it by the Expected Credit Loss (ECL) standard. IFRS9 accounting require banks to hold provisions for credit losses that are expected to occur, and the amount of provisious is subject to increase for loans whose credit quality has substantially deteriorated.

The ECL is measued over life of credit risky securities in the banking book. The ECl is a standard that is based on a forward-looking approach with a view on anticipated expected losses. Loss estimation is performed at stages conditional on the loan life cycle.

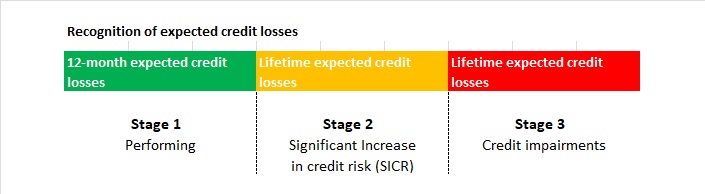

The Stages of Loss Estimation under IFRS 9

As a result of IFRS9, the IASB demised the Incurred Loss standard due to its delayed recognition of credit losses, and replaced it by the forward looking Expected Credit Loss (ECL) standard. The ECL standard is based on a forward-looking approach with a view on anticipated expected losses. Loss estimation is performed at stages conditional on the loan life cycle.

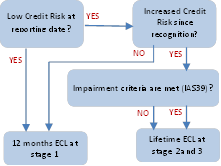

The three stages for impairments are based on changes in credit quality since initial recognition. Precisely, a loan is being classified impaired if the institution deems it unlikely to collect the full amounts on pricincipal and interest. The stage-2 categorization is based on the institution's definition of a significant increase in credit risk (SICR). This commonly includes regognition of loans 30+ days past due and loans that defaulted in the past 12 months since reporting. Other indications for SICR include a significant change in propability of default since origination. However, IFRS-9 is not defining a 'significant increase in credit risk' and institution need to decide on their own SICR criteria.

Stage 1 includes all securities with low credit risk at reporting date and where no significant increase in credit risk (SICR) has been observed since initial recognition. Expected Credit Loses (ECL) are calculated for 12-month horizon after the reporting date. Interest income is calculated on gross-carrying amount (without any deduction of credit allowance).

Stage 2 includes all securities with significant increase in credit risk (SICR) but without any recognition of impairment. Expected Credit Loses (ECL) are calculated for expected lifetime of security after the reporting date. Interest income is calculated on gross-carrying amount (without any deduction of credit allowance).

Stage 3 - includes all securities with recognition of impairment at reporting date. Expected Credit Loses (ECL) are calculated for expected lifetime of security after the reporting date. Interest income is calculated on net-carrying amount (with any deduction of credit allowance).

The Measurement of ECL

The IASB’s guidance on ECL is based on principles and institutions have to choose methods fitting to their organisational capacity. ECL requires the estimation of lifetime losses over the remaining life of an asset using supportable forecasts of economic conditions.

The measurement of ECL at stages 2 & 3 is conditional on the recognition of any significant increase in credit risk. Losses are projected over the remaining lifetime of assets. Obviously, any change in measurement from the one-year ECL to the Lifetime ECL will impact on the income statement.

An important modelling decision faced by risk management teams is the selection of plausible scenarios. Probability weighted computations of losses are required across multiple scenarios. Also, the input of macro factors to the ECL estimation may require long-range scenarios that capture mean reversion.

Moreover, an adjustment of the Basel PD is required before the PD can be used to input ECL calculations. Precisely, the regulatory PD is a through-the-cycle (TtC) PD and therefore less sensitive to changes in economic conditions. By contrast, the PD used to input ECL is a point-in-time (PiT) PD.

Goven the purpose underlying provisisioning, Loss calculations under IFRS 9 differ from Basel calculations. Current and projected economic conditions are taken into account for ECL computations, but not for Basel computations. Finally, the Basel capital is adjusted for shortfalls in provisioning by deducting any shortfall from the tier 1 capital.

The Use of Scenario Analysis

The forward looking view adopted for ECL measurement is based on the projection of macro variables under various plausible scenarios. A common approach is to compound ECL estimation of three scenarios, each associated with a distinctive narrative. For instance, the scenario deemed most likely should be reflective of average economic conditions, the two other scenarios should be reflective of up-and downside economic conditions.

Technically, it is the specification of a multivariate time series model that provides the blue print to calculate macro projections and to forecast errors for a set of macro variables. Among the multiple econometric methods that can be used to explain the historical fluctuations in macro variables are Vector Autoregression (VAR) and Vector Error Correction (VEC) models. The key variables of interest consist of PD, LGD and EAD. For these variables satellite models are used for conditioning based on the scenario projection. Based on this, forward-looking risk parameter over the life time of assets can be calculated.

The Impact on Capital Ratios

Having insight into the dynamic of IFRS9 ECL provisions on capital ratios enables banks to be aware of situations where capital ratios decrease below the required threshold level. The Capital Requirements Regulation (CRR) defines the amount of capital withheld to satisfy the requirements on capital ratios.

The calculation of capital ratios is dependent on the amount of provisions held to satisfy IFRS9 requirements. Common Equity Tier 1 (CET1) and Total Capital ratios are negatively influenced by provisions held.