We assist in Model Development endeavours with coverage of multiple model building techniques in the areas of Credit Risk, Portfolio Financial Risk, Stress Testing and Process Analysis. We have capacity to deliver end-to-end projects with guidance provided in conceptualizing, model building, model testing, coding & documentation, as well as independent validatons. Our skilled team members provide suitable expertise and enable knowledge transfer based on relevant experience.and industry practice.For further details, an outline of support in multiple model development is displayed below. For inquiries for support of functional teams towards a succesful project outcome contact us.

→ Contact

Disclaimer: Data, charts and commentary displayed herein are for information purposes only and do not provide any consulting advice. No information provided in this documentation shall give rise to any liability of Auriscon HK Ltd and Auriscon Ltd.

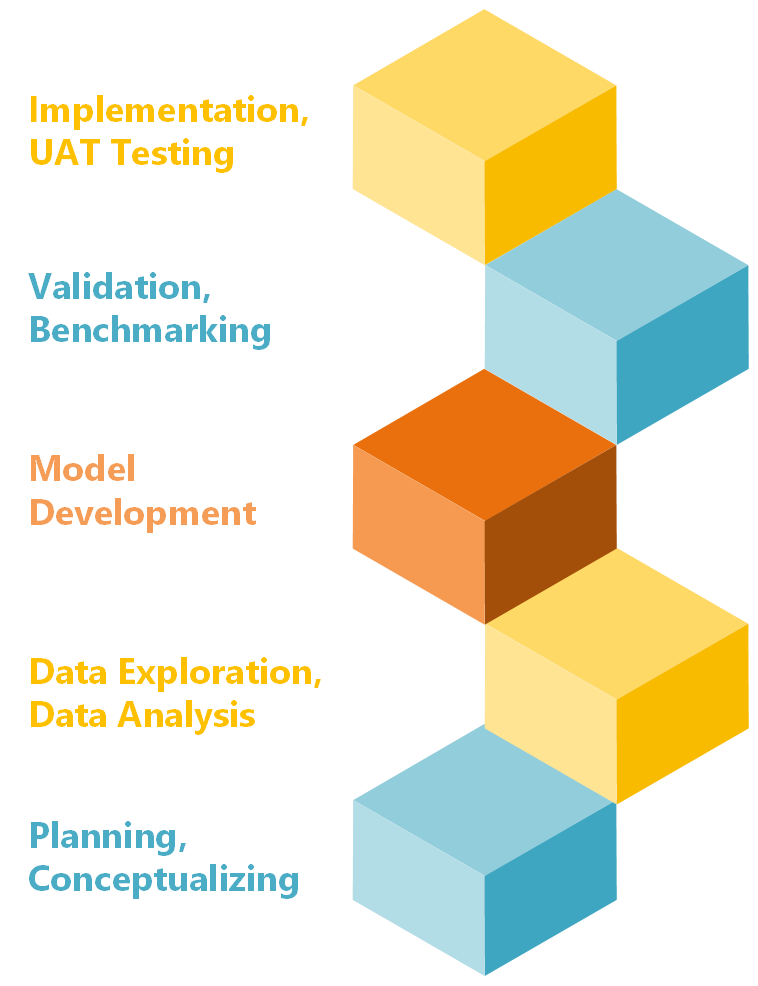

Our Approach

We involve our clients throughout the model development and validation process, beginning from the initial concept proposal and an agreed terms of reference through to the final implementation phase. Team member of Auriscon Limited have the right expertise. We can support on-site or by working remotely based on flexible allocations.

- We confidentially deal with methodological concepts and analytical models.

- We draw on business insights to deliver useful solutions.

- We advise on industry standards.

We assist and support our clients in Model development projects and we ensure objectives are realized in time. Our support help clients to successfully manoeuvre a challenging regulatory and market environment. In Credit Risk, our specialism ensures that credit models are aligned to industry practice and boosted sufficiently timely with respect to performance and profitabiliy aspects. In the area of Processes, we perform analysis and simulation using modern approaches and tools to obtain insights into the performance of processes. Finally, our support in the validation of models when scheduled before implementation provides timely insights into model effectiveness and risks.

CREDIT RISK

Model development and validation of multiple model types. Single name models used for Basel parameter and IFRS 9 comprising Probability of Default (PD) prediction, Behavioural Scoring, Expected Credit Loss ECL, Loss Given Default (LGD). Multi-name models used in Credit Portfolio Risk such as Default Risk Charge for the Trading Book and Risk-adjusted performance models for Credit Lending.

BOOSTING CREDIT MODEL PERFORMANCE

Evaluation and enhancement of credit model performance. Profitability driven Credit Analytics, to enable enhancing Credit Models through accounting for Profitability aspects and measures.

STRESS TESTING

Model concepts and developments covering Financial Risk Scenario Planning, Factor Identification, Vector Autoregression, Economic Trends.

MARKETING ANALYTICS

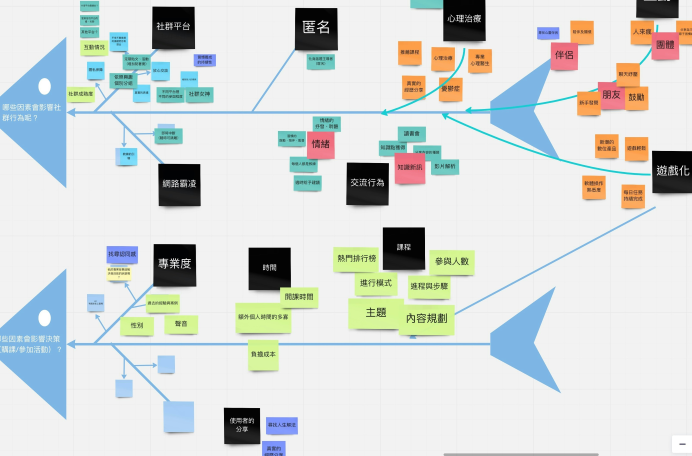

Building and preserving customer relationships, for example by using retention campaigns, should be supported by insightful analytics, tools and data. At Auriscon, we support in deliver exactly this with our assistance.

Illustration of our supporting activities

At Auriscon we can support on-site or by working remotely based on flexible allocations. We collaborate effectively with functional teams and stakeholders to assist in attaining the project goal. A few examples of how Auriscon can support your model development or validation projects are shown below for illustration.

WHAT

HOW

OBJECTIVE

Boosting Credit Model Performance

Boosting performance of Probability of Default (PD) and Loss Given Default (LGD) Models.

Targeted Outcome

- Increasing disciminatory power of PD and LGD credit models.

- Enhancing accuracy of prediction of PD models.

- Identifying profitability aspects hidden in Credit models.

Mitigating Model Risk

Identifying and quantifiying model risk related to sources nameley design, data, validation, etc.

Eloborating approaches to remediate the root causes and the impact.

Detecting

- Data issue due to incomplete work-outs.

- Validation shortcomings due to overfitting and lack of default data.

- Calibration issue due to lack of default data.

- Model design issues due to multicollinearity.

Including Macro linkages in Financial Stress Testing and Scenario Planning

Vector Autoregression (VAR) Models for quantification of macro linkages in Stress Testing and Scenario Planning.

Targeted Outcome

- Increasing disciminatory power of PD and LGD credit models.

- Enhancing accuracy of prediction of PD models.

- Identifying profitability aspects hidden in Credit models.

Marketing Analytics

Building and preserving customer relationships, for example by using retention campaigns, should be supported by insightful analytics, tools and data. At Auriscon, we support in deliver exactly this with our assistance.

Approach

- Customer retention modelling.

- Segmentation of customer groups.

- Identifying profitable customers.