The ongoing trend in using quantitative models for decision making prompted institutions and regulatory authorities to establish stricter rules on model risk management. Examples of this continuing expansion can be found in various model using areas e.g. the use of algorithms for trade execution in Securities Trading, the use of decision models in Credit Risk Analytics. Each of the various financial risk areas - whether it is Credit, Market or Liquidity Risk - entails model use cases and auditable model risk.

Our Aproach

is to advise and support our clients in audit planning and with subject matter expertise in audit testing to ensure their objectives are realized in time. This support ultimately adds value for our clients, to help them to manoeuvre successfully a rapidly changing regulatory and competitive environment that is imposing challenges onto the operation, compliance and strategy of their businesses. Contact us to request a sample brochure on our audit support.

→ Contact

We draw on business insights and deliver useful solutions. Auriscon's members advise customers on relevant industry standards throughout their engagements.

For further information, find below an outline of how audit testing can be enhanced with respect to data governance considerations and methodological approaches can be enhanced.

Planning

We support the planning and executing of audit examinations with regards to Model Risk, Data Governance, Credit Risk and Traded Risk.

Specialisation

Given our specialization in model risk and quantitative testing, we can provide relevant contribution throughout our assistance. We are a specialist provider in the technical audit field and draw insight from hands-on audit experience across multiple functional and business areas.

Anticipation

Our consultancy aims to identify latent and emerging risks to higlight issues at an early stage in the audit. Detrimental impacts of emerging risks will be highlighted and explained in relation to the context.

Approach

Our approach is based on holistic assessments drawing from Governance, Compliance and Methodology angles with detail testing added throughout.

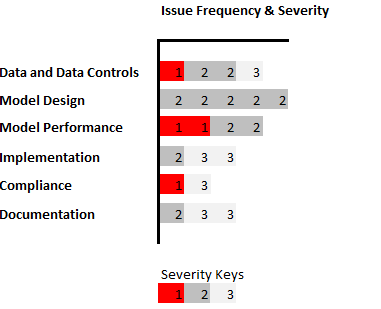

Examples of Model Risk

Model Risk can be traced to common root causes ranging from wrong use to limitations in data.

We exemplify common cases below.

leading to unsuitable model ouputs.

leading to estimation errors and overall inadequate model outputs

leading to bias in calibration and model output

The Audit Approach

Our audit approach is based upon industry standards.

- Highlight are engagements with business and process owners throughout the phases of the audit. We arrange milestone discussions with the management to ensure reflection on risk assessments is communicated and guided. Emerging risks, macro trends and incidents occuring in regulatory and economical contexts as well as prior review outcomes are considered and accounted for.

- The key element of our audit approach is rooted in aquiring an understanding of the business and the risks across markets, strategies and organisational structures.

- We focus primarily on material risks and we therefore apply a risk-based top-down driven approach, starting from a conceptual base line and reviewing the granular items identified through our fieldwork. We adhere to the institution's audit framework and planning structure however.

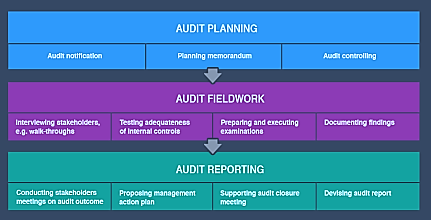

The Audit Phases and Activities

Audit activities occur in phases, with each phase consisting of specific tasks for preparing and inputting any subsequent phase. Of particular importance is the initial phase also known as Audit Planning. The planning phase is used to communicate the scope of the audit to auditees and management and to identify the areas of inherent and emerging risks.

The Audit Outcome and Reporting

Our approach to technical auditing ensures that controls marked as ‘critical’ receive prioritization during audit fieldwork and assessment.

We perform auditing through colloboration involving auditees and senior management to ensure audit tesitng is effective throughout.

The reporting of the Audit outcome will be clearly communicated and based on a consistent documentation.

Thematic drivers of issues will be identified and presented together with contextual information.

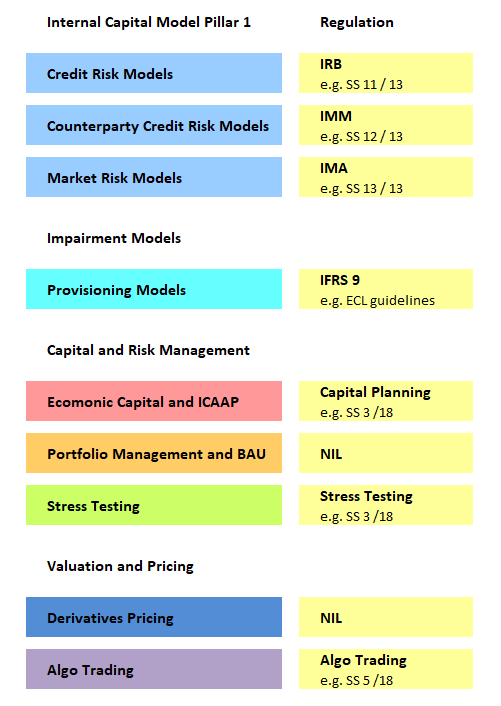

The Mapping of Risk Areas to Regulations

Regulators have confirmed that financial institutions must implement a Model Risk Management (MRM) framework. This includes setting up an adequate governance of Models with policy for model life cycle and a periodical follow-up with reviewing and assessments.