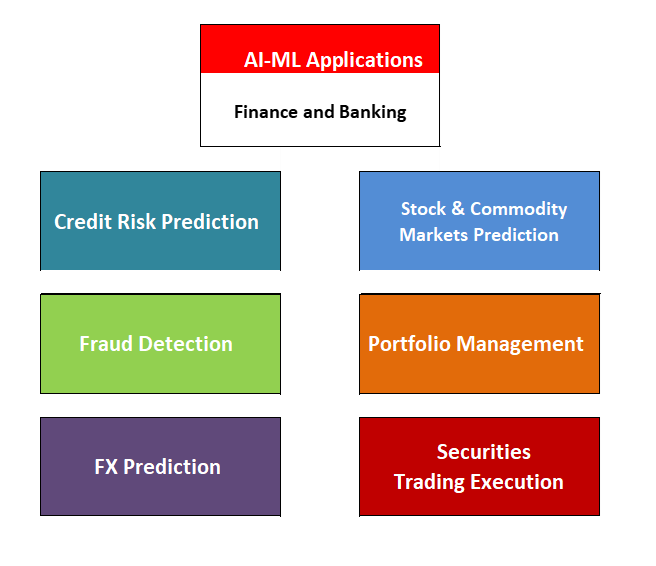

Enabled through advances in Information Technology (IT), Artifical Intelligence (AI) and Machine Learning (ML) finds applications across mulltiple areas of Finance. Today, the availability of machines and algorithms specialised in learning and decision making from data make applications possible that draw insight from complex and high dimensional data. The calibration of these algorithms typically takes large number of parameter and model configurations into account. This leads to the unique machine learning approach to calibrations enabling to build robust models with adaption to the most recent information and data.

Disclaimer: The information is provided for mere information purposes as part of this blog. Auriscon assumes no responsibility or liability for any errors or omissions in the content of this site. The information contained in this site is provided with no guarantees of completeness and accuracy. No liability is assumed by Auriscon for any damages that may occur for external use of information provided herein.

Technology such as Robotic Process Automation (RPA) as used in Business Process Automation (BPA) serves to execute complex tasks and to run processes in a business. Process automation enhanced by AI-ML driven workflows facilitate effectively the automation of complex decision-making tasks and thereby achieving enhanced performance with minimized error and cost.

Recurring data entry into databases is a laborous task that can be automated with the help of so called software bots. The process involving scanning documentation and populating databases is automated and improved. Dealing with customer queries is another application of AI-ML technology where chat bots are used to resolve issues and provide a personalized experience to customers.

Fraud detection in transaction processing in banks involves many detail steps for data screening and verification with anomalies being subject to investigation.

Enabled through advances in Information Technology (IT), Artifical Intelligence (AI) and Machine Learning (ML) applications are successfully applied across mulltiple areas of Finance. Today, the availability of machines and algorithms specialised in learning and decision draw insight from complex and high dimensional data.

Large Language Models (LLMs) are utilized throughout Finance and Banking. LLMs can significantly support in enhancing decision-making processes by integrating with predictive analytics. Businesses can generate forecasts based on current market trends and informed by historical data analysis thereby anticipating market changes and customer behavior. The FinTech industry is a known example for a business model that utilized the advantages of digitalization. Various specialized services are provided by the FinTech industry such as robot financial advisors that provide automated advising and assistance in portfolio management. Other automated services include peer to peer lending, crowd funding,and access to trading systems for a retail clientele.

Automating email drafting using LLMs leverages artificial intelligence to streamline communication processes. LLM can generate contextual and professionally articulated messages based on previous correspondences thereby reducing workload of personnel spent on composing emails. Moreover, Models can be trained to recognize the nuances of different types of emails distinguishing between updates, client inquiries, and requests. Integrating these systems with existing CRM (Customer Relationship Management) systems provides access to relevant data which can be used for a more engaging and tailored email correspondence.

Financial institutions use Machine Learning technology to support their investment decisions by identifying risks from historical data and probability is used to weight scenarios of possible outcomes and adjust risk management strategies. Training and validating AI-ML model can be a laborous and complex task with risks of errors in the model development and validation processes. At Auriscon we can help in identifying inconsistencies in the development and validation approach and point to opportunities to enhance model design and validation.

Whilst prediction is the process of reasoning forward from inputs to outputs, diagnostics is the reverse process that is reasoning back from any faulty output to the input (troubleshooting). However, when using the Bayesian Network technique, a combination of both forwards and backwards reasoning can be applied since a graphical structure is used to represent the network (directed acyclical graph). For instance, any unknown probability of a node in the graph can be computed and thus distincting between what are inputs and outputs is rendered flexibly.

Based on a Baysian Network the information flow from nodes representing causes to nodes representing events/symptoms is grapically displayed and based on the probability of events / symptoms being true inference of probabilities for causes can be performed.

Regularization techniques find applications for problems where a large number of variables are involved with significant correlations between pairs of variables unavoidable. For Regression models, Ridge and Lasso are the common techniques applied to ensure unbiased regression results in the presence of many correlated variables. A desirable side effect of Regularization is that regularized models can be expected to better generalize to out-of-sample data.

Demonstrated below an example of using Ridge Regression for prediction of House Price levels

Credit Applications for Loans are subject to automated decision making to discriminate between potential future defaulters and good obligors. From the various machine learing methods that can be applied in this context the Logistic Regression method is most common.Ensemble technqiues like Boosted Tree commonly compare favourably in performance to standalone techniques like Logistic Regression. Other Supervised Learning methods such as Artifical Neural Networks (ANN) are similarly effective. In applicatons of ANN, multi-layer networks are typically used whereby the number of layers is increased until no further increase in accuracy is significant.

Machine Learning techniques for Probability of Default (PD) and Loss Given Default (LGD) modelling can readily be compared to classical techniques such a Logistic Regression. Ensemble techniques like Boosted Tree commonly compare favourably in performance to standalone techniques like Logistic Regression. As example application for PD modelling is outlined below with respect to Boosted Trees.

Regularization techniques find applications for problems where a large number of variables are involved with significant correlations between pairs of variables unavoidable. For Regression models, Ridge and Lasso are the common techniques applied to ensure unbiased regression results in the presence of many correlated variables. A desirable side effect of Regularization is that regularized models can be expected to better generalize to out-of-sample data.

Demonstrated below an example of using Logistic Regression to Boosted Tree for the purpose of Loan Application scoring

Algorithmic Trading strategies are developed and applied based on algorithmic and machine learning signals. This approach enables the identificaiton of patterns with sufficient speed and accuracy, leading to fast prediction of securities prices and advising on trading decisions.

In the context of securities trading the volatility surface is an important concept for the pricing of options.The volatility surface of an option depends on the time to maturity and the strike price and evolves dynamically through time. Consequently, understanding the dynamics of a volatility surface is prerequesite for effective hedging and pricing. Using Neural Networks enables the modelling of the volatily dynamics without having to resort to complicated and at times slow traditional numerical pricing algorithms.

Generating synthetic data with the same properties as those observed in actual data is a desirable tool for many areas including Finance. Neural Networks in the form of Autoencoders and variations thereof provide the right technique for such a task. Autoencoders are also useful for dimensionality reduction, whereby a large number of features is reduded to a much smaller number of features that possess the same information content.

Anomaly detection for identifying unusual data for the processing of events or financial transactions can be based on different AI-ML techniques. The outcome can be used for the removal of unusal data (outlier) before actual model build or detection of unusal time series. Any detection of unusal data may be useful too to ensure that only trusted data is used to feed precition models.

Compliance is an area where attempts to prevent money laundering and to establish surveillance over transactions various machine-learning (ML) oriented approaches have become established. Within this context, ML methods are meanwhile commonly used within the context of customer screening. Caveats occur however due large number of false positives as operators have to process all false positives of an outcome run. Clearly, a business objective in this regards is to minimize false positives and thus reduce operational costs involved.

In Fraud detection Machine Learning models learn from identifying patterns of fradulent transactions. These patterns help to discriminate normalized from fradulent behavior and make it easier to detect suspicious activities, like money laundering or insider trading. Boosted Trees when used for Fraud detection provide an effective approach to account for a large number of features. In Gradient Boosting an ensemble of Trees is used for model fitting, with each iteration a new predictor is fitted to the errors hat remain from the previous sequence of models. Furthermore, Bayesian networks are suitable for anomaly detection since high dimensional data can be dealt with. N.B. Plotting individual variables can reveal simple anomolies but often anomalies are based on the interaction of many variables and hence more complex.

Reinforcement Learning can be useful in improving the performance of complex control systems under uncertainty. Complexity in such control systems may be characterised by many interconnected controls and value combinations which lead to a very large number of scenarios.

In Reinforcement Learning the rewards and costs of a particular strategy are accounted for as part of a sequential decision making process. In Finance, application of Reinforcement Learning is well suited to the dynamical nature of Portfolio Management, e.g. finding optimal risk and return decisions with executions performed in a multi-period setting under uncertainty. Optimal trade excecution is another example for application where the objective of the trading desk might entail to optimize the sale of a large block of trades without negatively affecting the sale price per share.