Stress Testing is a well established risk management tool used by financial institutions. Stress Testing is highly prioritized with respect to banks' capital due to the regulatory requirements that banks have to comply with.

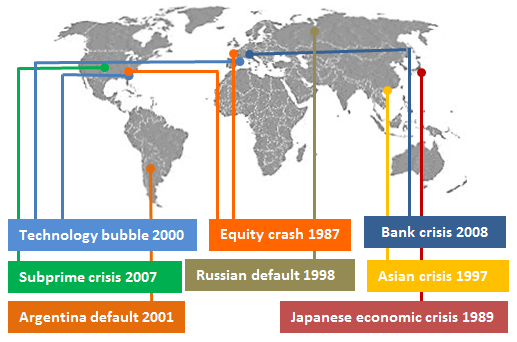

Stress Testing has applications across different asset classes and business objectives. Macro Stress testing for instance aids in exploring how past and hypothetical future shocks transmit to loss and the income conditions for portfolios. A major objective in this regards is to examine solvency and profitability in the advent of crisis. The following article provides a brief outline of historic crash events affecting Financial Markets pre 2008.

The Global Equity Crash 1987

The global recession that followed the stock market crash 1987 prompted revision of banking regulation. The S&P fell by 23% in one day in October.

The Japanese Economic Crisis 1989

The Japanese economy was growing significantly in the years before the crisis as based on a cheap currency, a low cost-wage base, and an expansion of credit. The latter drove stock and real estate markets to extreme heights.

The Japanese Nikkei 225 stock market index rose to unprecedented levels until the end of 1989, before the bubble was bursting. Afterwards, Japan had not recovered economic growth for a long time. In fact, the Japanese economy remained stagnant for decades.

The Russian Default on Debt 1998

In August 1998, Russia was forced to default on its sovereign debt and devalue the ruble. Russian inflation in 1998 reached 84%. Prior to this default and beginning in Dec 1997, the market prices of oil and metal began to drop. A chronic fiscal deficit and loss of confidence of investors were among the other reasons that led to the crisis.

The Asian Currency Crisis 1997

The crisis that developed in various Asian countries was caused by debt imbalances that accumulated by mid of 1997. As a result, currency devaluation, a sharp drop in stock prices and a rise in interest rates were setting in.

The New Economcy Technology Stock Bubble 2000

After a period of speculation on internet technology stocks lasting from 1997 to 2001 the dot-com crash occurred. The Nasdaq Composite stock market index, which included many internet company stocks, peaked in March 2000 before crashing.

The Argentina Debt Crisis 2001

Argentina defaulted on its international debt in Dec 2001. Argentina’s economy was strained by a recession in the late 90ties which, together with an appreciating US Dollar, rendered the Peso-Dollar currency pegging in place as economically expensive. The default of Argentina led the country to abandon the Peso-Dollar pegging. A significant depreciation of the Peso against the US Dollar was setting in early 2002.

The Sub-Prime Mortgage Crisis 2007

From 2004 to 2006 U.S. and Europe stock markets surged and interest rates fell to low levels. The use of securitisations became favourable to investment banks who sold securitised mortgages to investors who sought higher yields and to retail banks who sought a new way of funding their loans. Eventually the liquidity in the securitisation market disappeared, rates rose, and the stock market turned bearish.

The Banking Crisis 2008

Impacted by the sub-prime mortgage crisis leading to a credit crunch crisis, emerging stock markets fell and credit spreads widened. The widening of spreads led to higher costs for banks to fund their lending in interbank markets. To exemplify, share prices of many banks tumbled in 2008 and LIBOR rates rose to more than 200 bps above base rates. Several banks with a business model relying on MBS/CDO securitisations as a source of funding went bankrupt (e.g. UK based retail bank Northern Rock).